Family Trusts

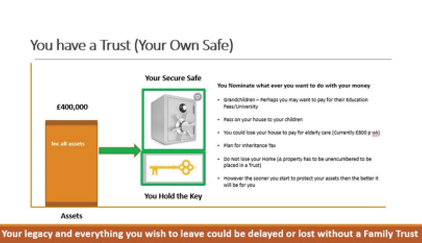

Your assets always remain in your possession (technically owned by the Trust so that nobody can gain access) and it is only once you have passed, that the key is then transferred so that others whom you nominate can benefit from the Trust

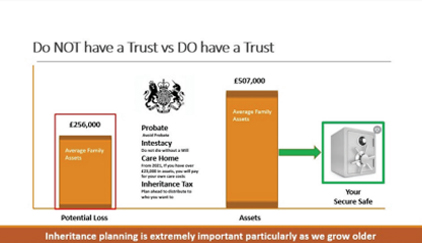

Example: If you have assets of over £23,000 (January 2021) the government would take your house and use it to pay for any residential care that you may require.

If you were to have your property put into a Trust, then this asset is ignored (all assets are ignored) and you would not have to pay for the residential care as your house would remain in the Trust until you passed or decided to do something else with it

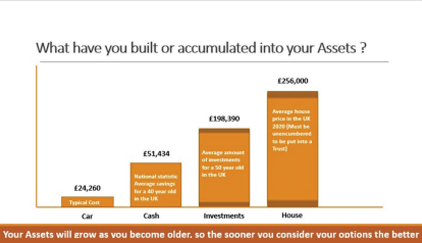

You can place almost anything into a Trust for various reasons that will assist you with inheritance tax planning.

REMEMBER – YOU CAN DO WHATEVER YOU WANT, AT ANYTIME, WITH ANYTHING YOU PLACE INTO THE TRUST, YOU CONTROL YOUR ASSETS.

What is a Trust?

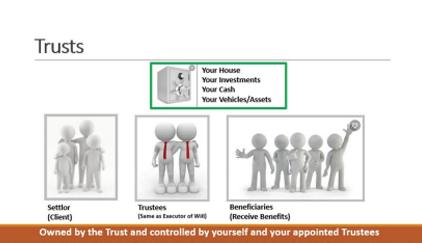

A Trust is a legal arrangement where you give cash, property, or investments to someone else, so they can

look after them for the benefit of a third person. So, for example, you could put some of your savings aside in a Trust for your children.

There are two important roles in any Trust that you should understand:

- The Trustee is the person who owns the assets in the Trust. They have the same powers a person would have to buy, sell, and invest their own property. It is the Trustees’ job to run the Trust and manage the Trust property responsibly.

- The Beneficiary is the person who the Trust is set up for and is usually unable to manage the Trust assets for themselves because they are too young, or they are not good at managing their own money. The assets held in Trust are held for the beneficiary’s benefit

What does a Trust do?

If you put things into a Trust then, provided certain conditions are met, they no longer belong to you.

This means that when you die their value normally will not be counted when your Inheritance Tax bill is worked out.

Instead, the cash, investments or property belong to the Trust. In other words, once the property is held in Trust, it is outside anyone’s estate for inheritance tax purposes.

Another potential advantage is that a Trust is a way of keeping control and asset protection for the Beneficiary; a Trust avoids handing over valuable property, cash, or investment whilst the Beneficiaries are relatively young or vulnerable.

The Trustees have a legal duty to look after and manage the Trust assets for the person who will benefit from the Trust in the end.

When you set up a Trust you decide the rules about how it is managed.

For example, you could say that your children will only get access to their Trust when they turn 25.

PLEASE READ THE ABOVE CAREFULLY UNDERSTANDING THAT YOU CAN PUT MONEY ASIDE FOR EXAMPLE TO PAY FOR A WEDDING OR GRANDCHILDRENS’ EDUCATION, HOWEVER WHEN THE TRUST IS SET UP CORRECTLY YOU WILL STILL HAVE TOTAL CONTROL OVER THE ASSET SO SHOULD YOU WISH TO CHANGE YOUR HOUSE OR TAKE OUT AN INVESTMENT THEN YOU CAN DO SO

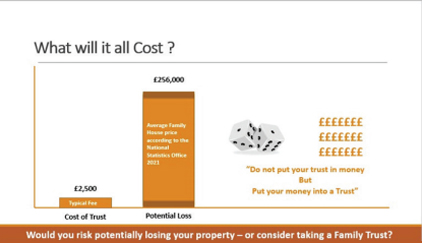

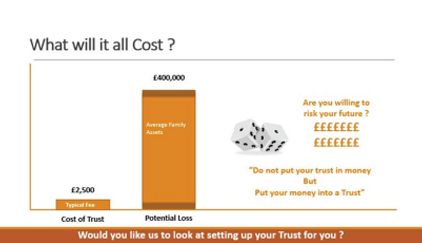

‘DO NOT PUT TRUST INTO YOUR MONEY PUT YOUR MONEY INTO A TRUST